The Panamanian real estate industry is recovering, driven by the sale of apartments and housing solutions of preferential and social interest.

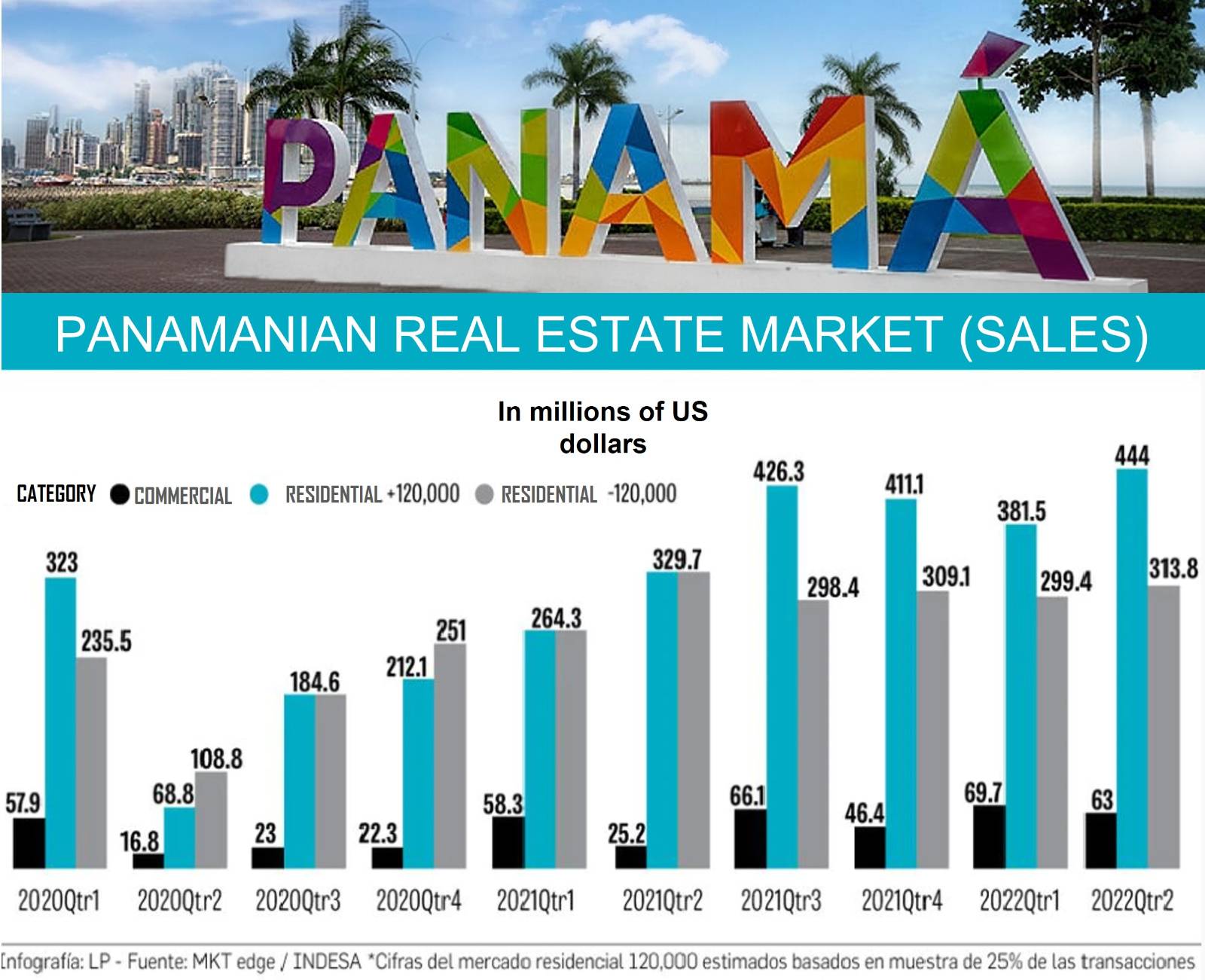

In the first half of the year, sales of 1.4 billion dollars were recorded in the residential segment, indicates the president of the Panamanian Association of Real Estate Brokers and Developers (Acobir), Francisco Cheng, highlighting that this amount comes from the volume of deeded sale in the Public Registry.

“When we compare this number of notarized contracts, with those that were signed and registered in the first half of 2021, it is an increase of 40%. If we look at the figures for 2020 when we had a difficult period, sales grew by more than 200%.”

This is not a rebound effect after the health crisis when the market reflected a contraction, since current sales also represent an increase of 30% compared to the volume of real estate marketed in 2019.

"The market has not only adjusted and recovered after the pandemic, but we see sustainable growth and a trend that will continue in the coming years."

Along with the natural growth of the housing market, real estate developers are proposing solutions and projects focused on the housing demand of young professionals looking to live in the city center.

Another driver of the market is the subsidy and preferential interest rates for a wide range of homes from 40,000 to 180,000 dollars per housing unit. "In 2019 the segment was expanded, covering homes for up to 180 thousand dollars, which has generated an increase so that more young families can opt for mortgage loans with affordable plans."

89% of the homes sold in 2021 are in the preferential interest range according to data from the National Council of Housing Promoters (Convivienda), that is, housing units worth up to 180 thousand dollars. While homes ranging from 180,000 to 350,000 dollars represented 10% of sales in 2021 and those that cost above 351,000 dollars per unit, they represented just 1% of billing.

According to the Superintendence of Banks of Panama (SBP), the placement of housing mortgage loans registered an increase of 5.8% in August of this year, for a balance of more than 16 thousand 669 million dollars.

“The preferential credits had a growth of 11.7% and the non-preferential ones of 1.3%. The foregoing implies that the performance of the housing market rests significantly on the subsidy regime”, indicates the banking regulator.

The inventory of homes to be placed in 2020 decreased due to the fact that new housing projects did not go on sale, going from 29 thousand units to 24 thousand units, on average.

Between 2021 and 2022, the housing inventory has averaged 19 thousand units, of which 6 thousand 500 are ready to occupy and the rest are under construction or planning. "Annually 7 thousand units are placed per year, which reflects that we maintain a healthy market."

SECTOR CHALLENGES

For the industry, these indicators reflect that there are good prospects, that the pace of recovery will be sustainable and that there will be an opportunity for local real estate brokers to continue innovating to offer personalized solutions and products.

Full note in / Source:

https://www.martesfinanciero.com/portada/crecen-las-venta-en-el-mercado-inmobiliario/